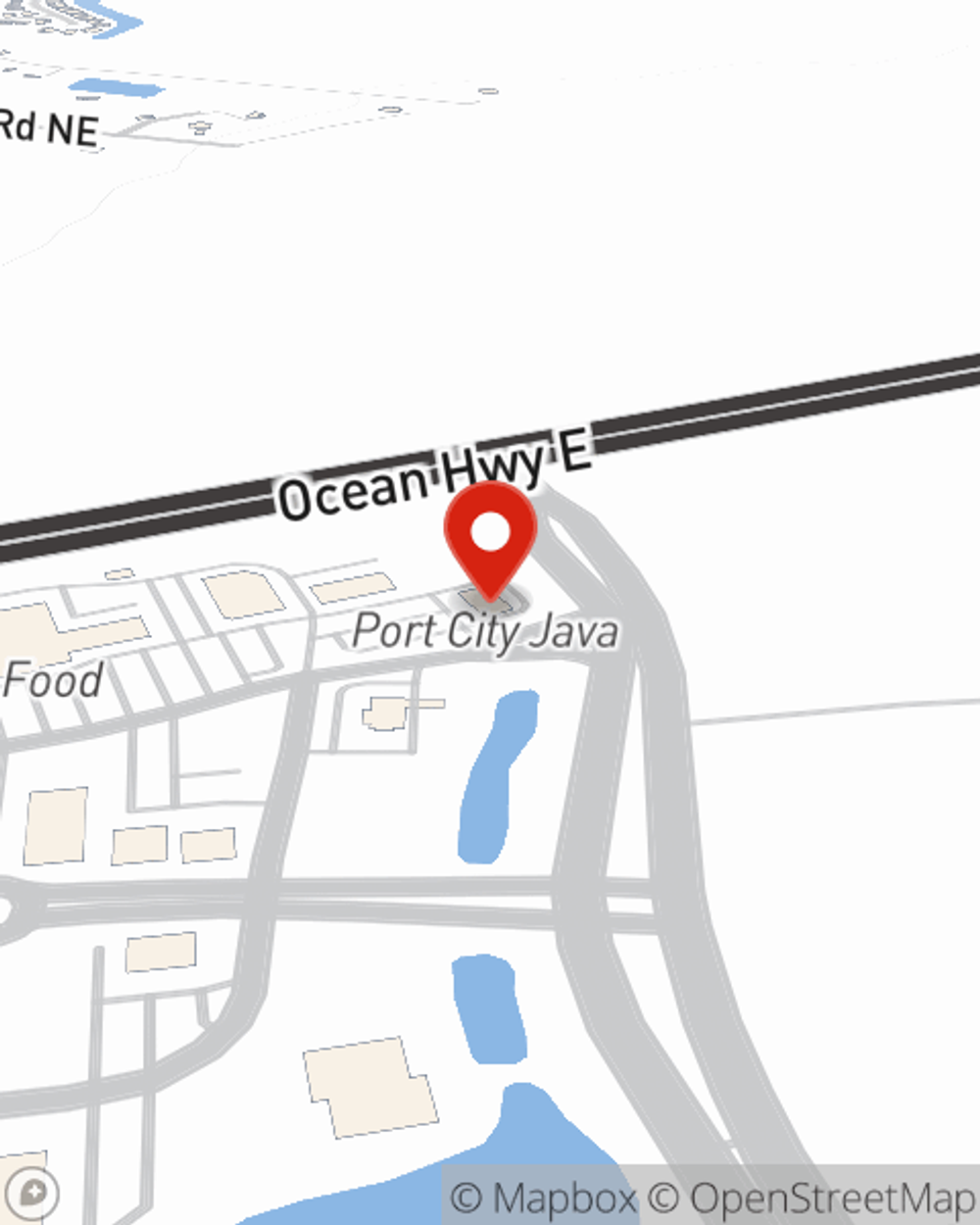

Business Insurance in and around Leland

One of the top small business insurance companies in Leland, and beyond.

No funny business here

- Leland

- Winnabow

- Belville

- Navassa

- Southport

- Supply

- Bolivia

- Calabash

- Shallotte

- Wilmington

- Hampstead

- Castle Hayne

- Brunswick County, NC

- New Hanover County

- Columbus County

- Pender County

- South Carolina

This Coverage Is Worth It.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Josh London help you learn about quality business insurance.

One of the top small business insurance companies in Leland, and beyond.

No funny business here

Insurance Designed For Small Business

For your small business, whether it's an antique store, an appliance store, a hobby shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like loss of income, equipment breakdown, and business property.

At State Farm agent Josh London's office, it's our business to help insure yours. Call or email our outstanding team to get started today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Josh London

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.